Commercial Solar Installation Costs: Save and Invest Wisely

Commercial Solar Installation Costs: Save and Invest Wisely

When you're looking at any major capital investment, the first question is always the same: "What's the bottom line?" For commercial solar, the average installation cost currently hovers around $1.46 per watt. But let's be clear—that's just a starting point.

The final price tag really depends on the scale of your project. Are you looking to power a few exterior lights, or are you planning a massive array for an entire industrial park? The answer dramatically changes the numbers.

Your Guide to Commercial Solar Installation Costs

Trying to understand the price of a commercial solar system can feel a bit like looking at the sticker price of a new car. You see the big number, but what's really under the hood? A solar project isn't just a pile of panels; it's a complete energy solution made up of hardware, skilled labor, and all the behind-the-scenes administrative work.

While the total investment can look substantial at first glance, breaking it down shows you exactly where every dollar is going. This turns a daunting figure into a strategic, manageable investment. It helps shift the conversation from "How much does it cost?" to "What value am I getting for this investment?" Seeing the cost distribution demystifies the whole process and makes it obvious why a custom quote is so important.

Deconstructing the Price Tag

The total cost is a sum of several key parts, which we in the industry group into two main buckets: hardware (the physical equipment) and "soft costs" (everything else needed to bring the project to life).

Let's pull back the curtain and look at how these components typically break down for a commercial solar project.

Breaking Down Commercial Solar Installation Costs

This table illustrates the primary components that make up the total cost of a commercial solar project, showing the typical percentage each category contributes to the final price.

Cost ComponentDescriptionTypical Percentage of Total CostSolar Panels (Modules)The core hardware that captures sunlight and converts it into DC electricity. The cost varies based on efficiency, brand, and technology.25% - 35%InvertersCritical devices that convert the DC electricity generated by the panels into usable AC electricity for your building.10% - 15%Racking & MountingThe structural support system that secures the panels to your roof or the ground. Costs depend on the type of roof and mounting style.8% - 12%Balance of System (BOS)Includes all other electrical components like wiring, conduits, and safety disconnects needed to connect the system safely.5% - 10%Installation LaborThe cost for skilled technicians to install the panels, mounting hardware, and electrical components.10% - 15%Permitting & InspectionFees paid to local authorities for project approval and ensuring the installation meets all safety and building codes.5% - 8%Engineering & DesignThe cost for engineers to design a system tailored to your building's specific energy needs and structural capacity.5% - 8%Other Soft CostsIncludes project management, customer acquisition, and overhead costs for the installation company.5% - 10%

As you can see, the physical hardware is really only half the story. The expertise in engineering, the project management, and all the necessary administrative work are just as crucial to getting a high-performing, reliable system installed.

Ready to see how these costs apply to your specific business? Explore our commercial solar services to get a detailed, no-obligation proposal.

What Drives the Final Cost of Your Solar Project

We hear this question all the time: "My warehouse is about the same size as the one across town, so why is my solar quote so different?" The simple answer is that every commercial solar project is a custom job. Think of it less like buying something off the shelf and more like commissioning a specialized piece of machinery for your business—every single decision and component shapes the final price.

Four key variables are the main drivers behind your final commercial solar installation costs. These are the system's size, the quality of the equipment you choose, the complexity of the installation itself, and even where your business is located. Getting a handle on how these elements work together is the first real step toward building an accurate budget and a smart energy strategy for the long haul.

System Size and Economies of Scale

One of the biggest factors influencing your cost per watt is just how big the system is. It’s like buying in bulk at Costco—larger solar projects benefit from economies of scale. The fixed "soft costs" we talked about earlier (think engineering, design, and permitting) don't scale up one-to-one with the size of the project.

This means the cost to design a massive 500-kilowatt (kW) system isn't ten times the cost of designing a 50 kW system. Those efficiencies get passed directly to you.

A larger solar array spreads the fixed costs over more watts, effectively lowering the price per unit of power. This is why a massive industrial rooftop installation will almost always have a lower cost-per-watt than a smaller system for a local retail store.

This principle is exactly why commercial solar is often cheaper per watt than residential. The larger scale allows for bulk purchasing of panels and hardware, more efficient use of labor, and a much better distribution of those essential soft costs.

Equipment Quality: The Upfront vs. Lifetime Value

Let's be clear: not all solar panels are created equal. The equipment you select is a critical balancing act between your upfront budget and the system's long-term performance and reliability. It’s the classic trade-off.

Here’s a quick look at the key equipment decisions you'll face:

Solar Panels (Modules): You can go with standard panels that offer solid performance at a great price, or you can opt for premium, high-efficiency panels. The premium ones cost more today but generate more power per square foot and usually come with better warranties and degradation rates. That translates to bigger savings over the system's 25- to 30-year lifespan.

Inverters: These are the brains of the operation. Your options range from standard string inverters to more advanced microinverters or power optimizers, which are fantastic for improving performance in tricky, shaded conditions and give you panel-level monitoring.

Racking and Mounting: The hardware that secures everything is also a variable. A standard fixed-tilt system on a flat roof is the most common and cost-effective. But you might also consider tracking systems that follow the sun to squeeze out every last drop of energy, though they come with a higher initial price tag.

Choosing the right equipment isn’t just about the initial bill; it’s about investing in decades of reliable, clean power for your business. Our team can walk you through a cost-benefit analysis of different equipment tiers to find the perfect fit with our expert solar services.

Installation Complexity and Labor Costs

Where and how the panels are installed can move the needle on your final price in a big way. A simple, wide-open flat roof on a single-story building? That’s the most straightforward and cost-effective scenario you can get.

However, several things can add complexity and, by extension, drive up labor and material costs:

Roof Type and Condition: Putting panels on a pitched metal roof is a completely different job than working on a flat membrane roof. If your roof needs repairs or reinforcement before the panels can go up, those costs have to be baked into the budget.

Ground-Mount Systems: If you're short on rooftop space, a ground-mounted array is a fantastic alternative. But it requires more site prep—think trenching for electrical lines, pouring concrete footings, and clearing land—all of which adds to the project cost.

Site Accessibility: A site with easy access for cranes and delivery trucks will naturally have lower labor costs than a cramped urban location that requires a logistical puzzle to be solved first.

At the end of the day, a more complex installation demands more specialized labor, more materials, and more time. All of that contributes to the final commercial solar installation costs. This is where having professional guidance is invaluable; we provide the clarity you need to move forward with our solar services.

Geographical Location and Local Factors

Finally, where your business is located plays a surprisingly large role. National market trends set a baseline, but local conditions are what really fine-tune the final price. For instance, recent U.S. trade policies and tech advancements have created some interesting dynamics. For Q1 2025, the average commercial system price actually dropped 2% year-over-year to about $1.47 per watt, even while module prices were rising due to tariffs. Why? Because new, hyper-efficient panels are reducing other system costs. You can dive deeper into these trends in the latest Solar Market Insight Report.

Beyond the big picture, things like local labor rates, how difficult the municipal permitting process is, and even the amount of sunshine (solar irradiance) in your area all impact a project's cost and viability. This is why working with an installer who knows the local landscape inside and out is so important. Ready to see how these factors apply to your business? Explore our expert solar services for a detailed assessment tailored to your needs.

How Global Market Trends Affect Your Local Solar Investment

Even though your business is local, the price you'll pay for a solar installation is heavily influenced by what’s happening on the other side of the world. It’s a bit like the price of gas at the pump—global supply and demand, shipping logistics, and international politics all play a role. The same is true for solar; your commercial solar installation costs are tied directly to a massive, interconnected global market.

For years, the overarching story in the solar industry has been a dramatic drop in prices. This wasn’t just a minor dip; it was a game-changing freefall driven by relentless innovation and an explosion in manufacturing scale. This trend has turned solar panels from a pricey niche product into one of the most affordable sources of new energy on the planet, making them a brilliant asset for any business trying to get a handle on operating costs.

The Power of Global Manufacturing and Innovation

The biggest reason for plummeting solar costs is the sheer efficiency of modern global manufacturing. As production has gone from thousands of panels to billions, manufacturers have perfected their processes, slashed waste, and started buying raw materials in enormous bulk. It's this constant drive for improvement that has consistently pushed down the price of solar modules, making large commercial projects more financially sensible than ever before.

This global momentum is a powerful force. The cost of commercial solar installations keeps falling worldwide thanks to new tech and huge manufacturing capacity. In fact, a recent report from BloombergNEF found that fixed-axis solar farms saw a staggering 21% drop in installation costs globally in 2024 alone. A big part of that is an oversupply in the market, where modules are sometimes sold near or even below their production cost—a trend that directly benefits businesses like yours. You can dig deeper into these trends in the full 2025 report.

This downward pressure from global markets is a strong tailwind for your investment, meaning you get more generating power for every dollar you spend. Our solar services ensure you take full advantage of these market trends.

Navigating Short-Term Market Turbulence

While the long-term trend is clearly downward, the global market isn't always a smooth ride. Just like any worldwide supply chain, the solar industry hits patches of volatility. Think of these as temporary headwinds that can cause prices to fluctuate for a bit.

Here are a few things that can cause these price swings:

Import Tariffs: Trade policies can add unexpected costs to imported solar components, which can temporarily bump up the price of modules and hardware.

Supply Chain Disruptions: Global events, from shipping logjams to factory shutdowns, can create bottlenecks that affect the availability and price of key solar parts.

Raw Material Costs: The prices of essential materials like silicon, silver, and aluminum can swing based on global demand, which trickles down to the final manufacturing cost.

It's crucial to see these for what they are: short-term bumps on a long-term downward slope. A good installation partner is always watching these trends, helping you time your investment to sidestep the volatility and lock in the best possible price.

The Battery Storage Revolution

Another global trend completely changing the solar equation is the falling cost of battery storage. As battery technology gets better and manufacturing ramps up, energy storage is becoming an affordable and logical addition to commercial solar projects.

This is a true game-changer. Pairing your solar array with battery storage turns it from a simple energy-saving device into a full-blown energy management system. It lets you store the cheap, clean power you generate during the day and use it during expensive peak hours or, even better, during a grid outage. This doesn't just maximize your savings; it builds real operational resilience for your business.

The one-two punch of falling panel prices and affordable storage is making solar a more powerful and strategic asset than ever before. To see how these global trends can translate into specific savings for your business, contact our team to explore our expert solar services.

Turning Solar Expenses Into Strategic Assets

Thinking of a commercial solar project as just another expense is a common mistake. With the right financial game plan, it stops being a line item on your budget and becomes a hard-working asset that generates real value. The trick is to understand how powerful incentives and smart financing can slash your net commercial solar installation costs and put your return on investment on the fast track.

This is about more than just trimming your utility bills; it's a strategic financial move. When you take full advantage of the financial tools out there, you completely change the project's economics. What starts as a capital expenditure quickly becomes an engine for long-term savings and predictable operating costs.

Maximizing Your Returns with Key Incentives

The government rolls out the red carpet for businesses adopting clean energy. These aren't just small discounts—they're powerful financial levers that can cut the net cost of your system by more than half.

Two of the most impactful incentives at the federal level are:

The Federal Investment Tax Credit (ITC): This is the heavy hitter of solar incentives. It lets you claim a tax credit for 30% of your total project cost. That’s a dollar-for-dollar reduction of what you owe the IRS, giving your project's financial outlook an immediate and massive lift.

Accelerated Depreciation (MACRS): The Modified Accelerated Cost-Recovery System (MACRS) lets you write off the value of your solar investment. Under the current rules, you can depreciate 100% of the system's value in the very first year. This creates a huge reduction in your taxable income.

Combine the ITC and MACRS, and the financial impact is game-changing. It's not uncommon for businesses to see these two incentives cover 50-60% of the total system cost within the first year of turning the system on.

On top of federal programs, many states, local governments, and even utility companies offer their own rebates and performance-based incentives. These can sweeten the deal even more, chipping away at the upfront cost and shortening your payback period.

Choosing the Right Financing Playbook

Once you've mapped out the incentives, the next step is picking a financing path that fits your company's cash flow and financial goals. There are really three main ways to fund a commercial solar project, and each has its own distinct pros and cons.

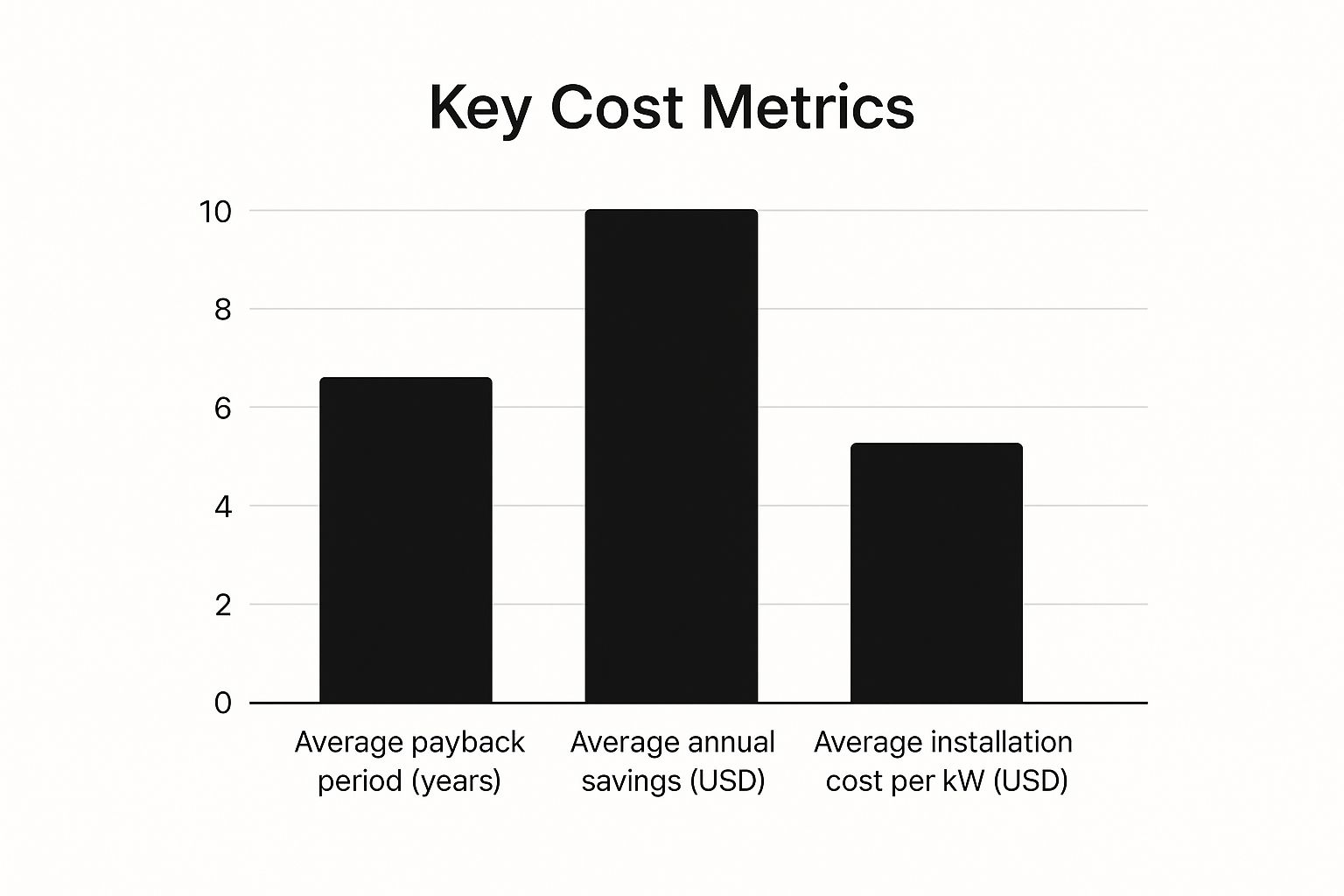

This infographic gives you a bird's-eye view of the financial metrics you can expect when you invest in commercial solar.

The numbers speak for themselves. While there's an initial investment, the long-term savings and payback potential make solar an incredibly compelling financial decision for almost any business.

Comparing Commercial Solar Financing Options

To figure out the best approach, it helps to see the most common financing methods side-by-side. This table breaks down the key differences in ownership, upfront costs, and who gets to pocket the financial benefits.

Financing OptionUpfront CostOwnershipIncentive EligibilityBest ForDirect Cash PurchaseHighYou own the systemYou claim all tax credits & depreciationCompanies with available capital looking to maximize long-term ROI and own the asset outright.Solar LoanLow to NoneYou own the systemYou claim all tax credits & depreciationBusinesses that want ownership benefits without a large initial cash outlay, using energy savings to cover loan payments.Power Purchase Agreement (PPA)NoneA third party owns the systemThe third-party owner claims the incentivesOrganizations wanting immediate savings with zero upfront cost and no responsibility for system maintenance or performance.

Let's unpack these a bit.

A direct cash purchase delivers the biggest long-term ROI, hands down. You own the system and every kilowatt-hour of energy it produces from day one. Plus, all those lucrative tax incentives go directly into your pocket.

A solar loan is a fantastic middle-of-the-road option. It lets you own the system and claim the tax benefits without tying up a huge chunk of capital. Often, the monthly energy savings are actually higher than the loan payment, meaning the project is cash-flow positive right out of the gate.

Finally, a Power Purchase Agreement (PPA) is the most straightforward path to savings. A solar developer installs and owns the system on your property, and you simply agree to buy the power it generates at a fixed, lower-than-utility rate. You get zero upfront cost and zero maintenance headaches, though the long-term savings aren't as high as with direct ownership.

By carefully matching the right incentives with the right financing structure, you can design a solar project that doesn't just lower your commercial solar installation costs—it creates a durable financial asset for years to come.

Ready to find out which financing option is the perfect fit for your business? Contact our team to explore our expert solar services and get a customized financial analysis.

Calculating Your Commercial Solar Payback and ROI

Once we've looked at incentives and how to pay for a system, the conversation always turns to the bottom line. How long until this investment actually pays for itself? What kind of return can you realistically expect? These are the questions that take a solar project from a "nice idea" to a strategic business decision.

Thankfully, figuring out your solar payback period and return on investment (ROI) is more straightforward than you might think.

Here’s a simple way to look at it: your monthly utility bill is like a subscription you can never cancel, with rates that only seem to go one way—up. A solar installation, on the other hand, is a one-time purchase that essentially replaces that unpredictable, lifelong expense with a fixed, predictable asset that generates value. The goal is to pinpoint exactly when the savings from your new asset overtake its initial cost.

Demystifying Key Financial Metrics

To get started, let's break down the two most important numbers you'll hear about. These are the bedrock for judging how well a solar investment performs financially.

Payback Period: This one is simple. It’s the time it takes for the savings from your solar system to add up and completely cover the net cost of the installation. If a system has a net cost of $150,000 after incentives and saves you $25,000 a year, your payback period is six years.

Return on Investment (ROI): This gives you a much deeper look at the system's performance over its entire life. It measures the project's profitability, usually shown as an annual percentage, much like any other investment.

Recent data shows the average payback period for commercial solar is around 10.5 years, with an average ROI of 13.56%. For many businesses, that kind of predictable return, based on something as reliable as sunshine, often looks better than more traditional, volatile investments.

A Step-by-Step Framework for Your Calculation

Forecasting your savings means looking at a few key variables. You'll need your current electricity costs, a solid projection of your system's energy production, and any extra income you might generate from renewable energy credits.

Let's walk through a quick, simplified example:

Calculate Annual Savings: Grab your last 12 months of utility bills to find your average annual electricity cost. Let’s say you spent $30,000. If your new solar system is designed to offset 90% of that usage, your first-year savings are a cool $27,000.

Factor in Rate Hikes: Utility rates aren't static; they tend to climb. Even a conservative estimate of a 3% annual increase means your savings will actually grow each year. In year two, you’d save more simply because the electricity you're avoiding would have cost more.

Account for System Degradation: Solar panels do lose a tiny bit of efficiency over time—a process called degradation. Most high-quality panels come with a warranty guaranteeing they'll produce at least 85% of their original output after 25 years. This translates to a minimal annual performance drop of about 0.5%.

By adding up your escalating annual savings and subtracting the minimal degradation, you can create a clear forecast of your financial returns over the system's 25- to 30-year life. This detailed analysis is something our team specializes in. You can learn more about our company's mission to provide this kind of clarity to California businesses.

The Value Beyond the Spreadsheet

While the numbers are definitely compelling, a purely financial view misses a huge part of the picture. The true value of installing solar on your property extends far beyond the payback period.

These non-financial returns can be powerful strategic assets. You're boosting your brand's reputation with a tangible commitment to sustainability and hitting corporate ESG (Environmental, Social, and Governance) targets. Perhaps most importantly, you’re securing your operational resilience, protecting your business from grid outages and unpredictable energy price spikes.

Solar isn't just a cost-saving tool; it's an investment in a more stable, sustainable, and profitable future. To see a detailed ROI calculation for your specific property, explore our solar services today.

Integrating Solar Into Your Energy Future

A commercial solar installation isn't just about putting panels on your roof anymore. It's really the cornerstone of a modern, independent energy strategy. We're seeing smart businesses look past simple cost-cutting and start building powerful energy ecosystems that create real resilience and a long-term competitive advantage. Think of it as future-proofing your business against unpredictable utility rates and an increasingly shaky grid.

The whole conversation has shifted. It’s no longer just about generating power; it’s about managing it. This simple change in perspective turns what was a one-time investment into a dynamic asset that can actually grow and adapt with your company.

Unlocking Energy Independence with Battery Storage

If you want to unlock true energy freedom, pairing your solar array with battery storage is the way to do it. Solar panels are incredible at cranking out low-cost energy when the sun is out, but what about when it gets dark or the grid goes down? That's where batteries come in.

You can store all the excess clean energy your system produces during the day and then use it exactly when you need it most. This means you can wipe out those expensive peak demand charges from the utility or—even more importantly—keep the lights on and your business running during a blackout. It's the best insurance policy you can get against disruption.

A solar-plus-storage system effectively turns your facility into its own self-sufficient energy island. You get to decide when to use your own clean power, breaking free from the utility's unpredictable pricing and reliability.

Powering the Future with EV Charging Synergy

The link between solar and electric vehicle (EV) charging is another massive opportunity that's just starting to take off. As more businesses switch their fleets to electric, having on-site charging isn't just a nice-to-have; it's becoming essential. And what’s the cheapest way to power those chargers? With the solar energy you're generating right on-site.

This integration lets you fuel your company vehicles with clean, practically free energy. But it doesn't stop there. By offering public EV charging, you can open up a brand new revenue stream, draw in new customers, and establish your brand as a real leader in sustainability.

A big reason we're seeing commercial solar explode is because of these integrations with storage and EV infrastructure. In fact, market forecasts for 2025 are expecting at least 7.1 gigawatts of new commercial solar capacity, and these value-adds are a huge driver. You can get a closer look at the 2025 commercial solar installation projections to see just how big this trend is becoming.

When you look at it this way, your commercial solar installation costs stop being an expense. They become a strategic investment in decarbonizing your company and making your operations rock-solid. Ready to build your energy future? Explore our expert solar services to design a complete energy solution for your business.

Begin Your Commercial Solar Project with Confidence

Now you have a solid grasp of what goes into the cost of a commercial solar installation. We've walked through how a significant upfront investment can turn into one of the smartest financial moves a business can make, thanks to falling equipment prices, powerful incentives, and massive long-term energy savings.

The real key, though, is shifting from this general understanding to a specific analysis of your own facility. The journey from just being curious to having real clarity is shorter than you might think.

From Information to Action

The power isn't in knowing the averages; it's in seeing exactly how these financial models and system benefits apply directly to your operations and your bottom line. Armed with this knowledge, you're ready for the most important step.

A confident investment decision needs real numbers and a clear plan. A customized proposal is what cuts through the estimates and gives you the concrete data you need. It takes abstract concepts like payback period, ROI, and incentive value and turns them into a specific financial forecast for your business.

A well-designed solar project is more than just an energy system. Think of it as a long-term business asset that delivers predictable returns, enhances your brand, and secures your operational future against unpredictable energy costs.

If you're ready to see exactly what solar can do for your business, the next step is simple. The path to energy independence and lower costs starts with a single conversation. Inquire about our solar services to get started.

Take control of your energy expenses and start your solar project with confidence. The team at Rate Reduction California is ready to provide a free, no-obligation consultation and a custom proposal built for your facility’s needs. Contact our solar experts today to get the clear numbers you need to invest in a brighter, more profitable future.